irs child tax credit problems

Well continue to update this story as. However if youve received that document and noticed the information is incorrect.

Irs Tax Services In Los Angeles Ca Infographic Irs Taxes Tax Guide Tax Services

In addition one of my child has SSN another one has ITIN so the.

. The IRS is expected to send out the first advance child tax credit payment to millions of American families in roughly two weeks as part of President Joe Bidens 19 trillion. They say its causing stress and. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit.

But there still may be some last-minute hurdles to overcome. Reports of incorrect dollar amounts on Letter 6419. Starting 15 July the IRS will begin sending advance monthly payments to parents for the 2021 Child Tax Credit.

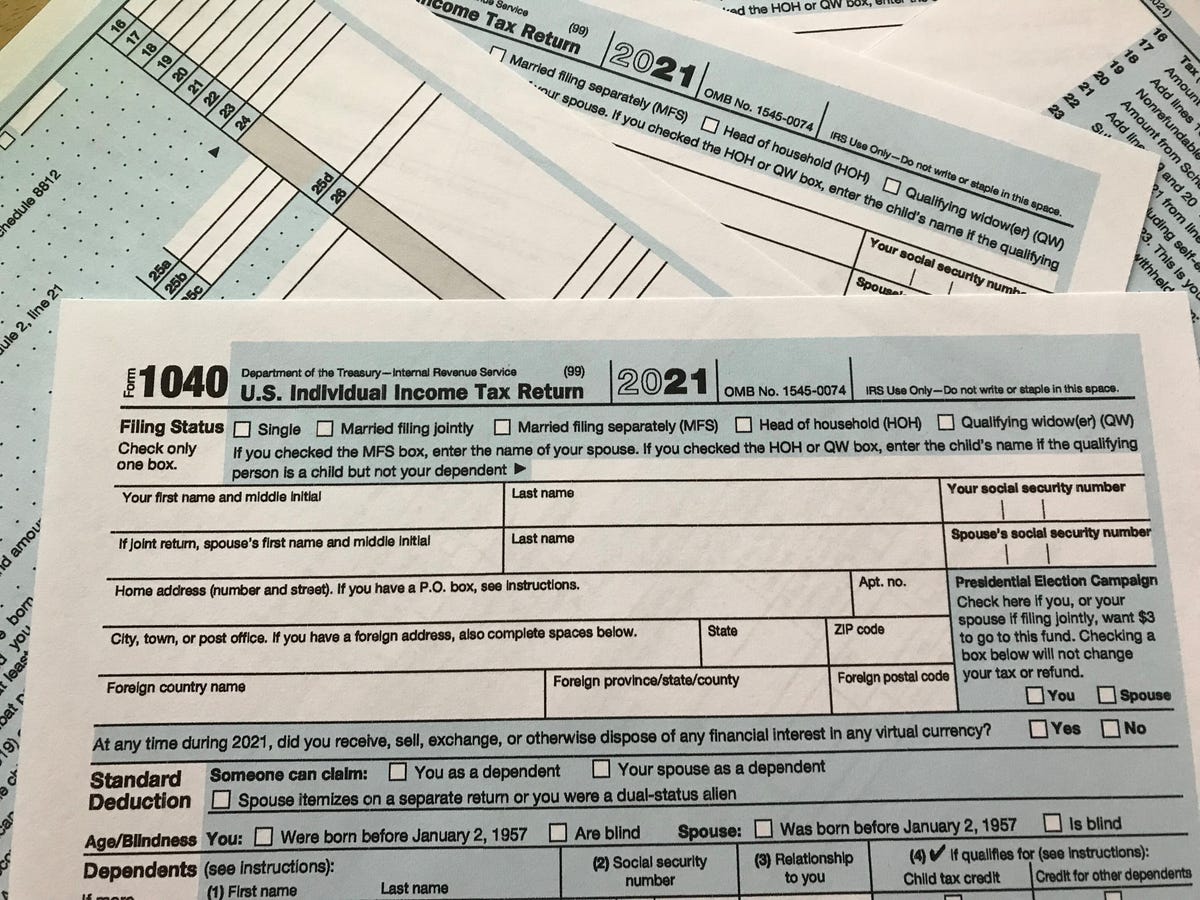

If you have children and received child tax credit payments in 2021 youll need a Letter 6419 from the IRS. Monthly checks have ended for now. IRS Letter 6419 includes all the info youll need to reconcile your child tax credit when you file your taxes.

HOUSTON - Many people continue to have problems receiving their child tax credit payments or have received math error notices from the IRS. IRS Admits Errors in Child Tax Credit Letters Sent to Taxpayers. That comes out to 300 per month and 1800.

That means if a five-year-old turns six in on or before December 31 2021 the parents will receive a total Child Tax Credit of 3000 for the year not 3600. What should you do if you havent received a payment or got the wrong amount. The Child Tax Credit Update Portal is no longer available.

TAdmitting that they expect another chaos-filled filing season Treasury and the IRS have been encouraging taxpayers who received advance payments of the Child Tax Credit. The current changes to the 2021 child tax credit made the credit 3600 for children under age 6 and let families qualify if they have little or no income. A group of parents who received their July payment via.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The IRS urged extra caution for those who received money through the advance child tax credit and the third stimulus payment. The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. I didnt receive any advanced child tax credit payments which could be due to our income is beyond 150000. To be a qualifying child for.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc Tas

Flat Fee Tax Service Tax Debt Irs Taxes Tax Time

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Irs Offers New Details On Glitch That Delayed Child Tax Credits Top Stories Nny360 Com

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

How I Became An Accountant From An Unlikely Beginning To An Rewarding Career Lessons Learned In Life Lessons Learned Enrolled Agent

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Summer Camp Tax Credit Infographic Https Www Idtech Com Blog Is Summer Camp Tax Deductible Infographic Id Tech Summer Camp Infographic

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Income Tax Return Irs

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Irs Taxes Tax Debt Tax Help

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Child Tax Credit Irs Unveils Address Change Feature For September Payment

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj